2024

(with Jiang, Matvos and Piskorski), 2024. Forthcoming, Journal of Financial Economics

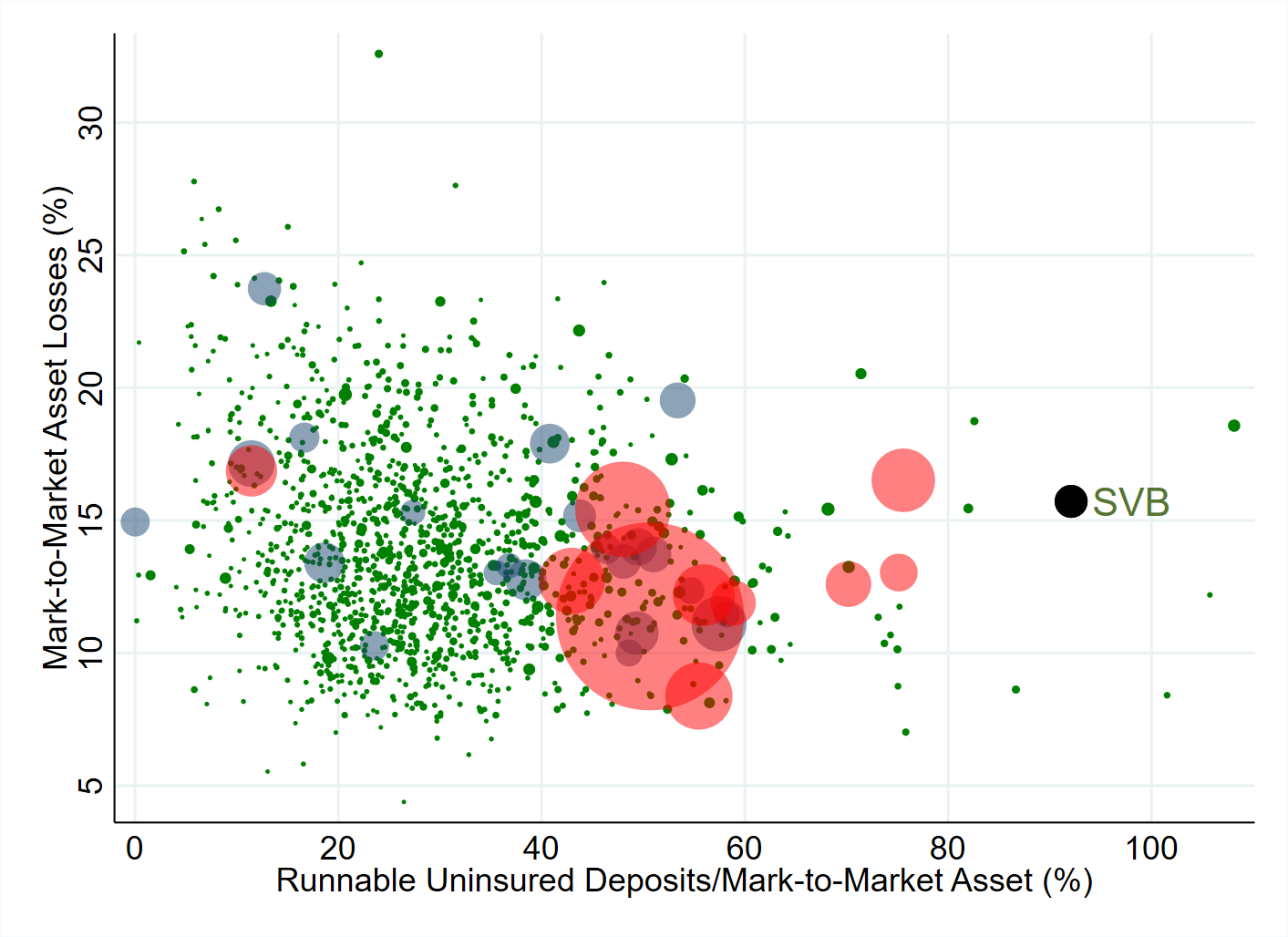

We analyze U.S. banks’ asset exposure to a recent rise in the interest rates with implications for financial stability. The U.S. banking system’s market value of assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity. Marked-to-market bank assets have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%. Most of these asset declines were not hedged by banks with use of interest rate derivatives. We illustrate in a simple model that uninsured leverage (i.e., Uninsured Debt/Assets) is the key to understanding whether these losses would lead to some banks in the U.S. becoming insolvent– unlike insured depositors, uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run. We show that a bank’s survival depends on the market beliefs about the share of uninsured depositors who will withdraw money following a decline in the market value of bank assets. If interest rate increases are small such that the bank’s decline in asset values is relatively small, there is no risk of a run equilibrium. However, for sufficiently high increases in interest rates, we have multiple equilibria in which uninsured depositor run making banks insolvent (i.e., a “bad” run equilibrium) becomes a possibility. Banks with smaller initial capitalization and higher uninsured leverage have a smaller range of beliefs supporting a “good” no run equilibrium, increasing their fragility to uninsured depositor runs. A case study of the recently failed Silicon Valley Bank (SVB) is illustrative. 10 percent of banks have larger unrecognized losses than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent of banks having lower capitalization than SVB. On the other hand, SVB had a disproportional share of uninsured funding: only 1 percent of banks had higher uninsured leverage. Combined, losses and uninsured leverage provide incentives for an SVB uninsured depositor run. We compute similar incentives for the sample of all U.S. banks. Even if only half of uninsured depositors decide to withdraw, almost 190 banks with assets of $300 billion are at a potential risk of impairment, meaning that the mark-to-market value of their remaining assets after these withdrawals will be insufficient to repay all insured deposits. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk. Regions with lower household incomes and large shares of minorities are more exposed to the bank risk. We also show that decline in banks’ asset values eroded the ability of banks to withstand adverse credit events – focusing on commercial real estate loans. Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs.

(with Agarwal, Matvos, Grigsby, Hortacsu and Yao), 2024. Forthcoming, Econometrica

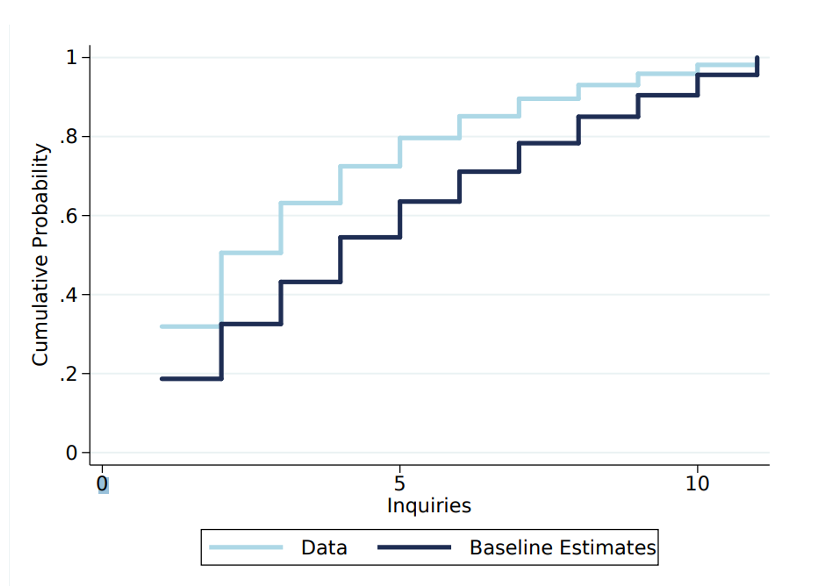

We study the interaction of search and application approval in credit markets. We combine a unique dataset, which details search behavior for a large sample of mortgage borrowers, with loan application and rejection decisions. Our data reveal substantial dispersion in mortgage rates and search intensity, conditional on observables. However, in contrast to predictions of standard search models, we find a novel non-monotonic relationship between search and realized prices: borrowers, who search a lot, obtain more expensive mortgages than borrowers’ with less frequent search. The evidence suggests that this occurs because lenders screen borrowers’ creditworthiness, rejecting unworthy borrowers, which differentiates consumer credit markets from other search markets. Based on these insights, we build a model that combines search and screening in presence of asymmetric information. Risky borrowers internalize the probability that their application is rejected, and behave as if they had higher search costs. The model rationalizes the relationship between search, interest rates, defaults, and application rejections, and highlights the tight link between credit standards and pricing. We estimate the parameters of the model and study several counterfactuals. The model suggests that overpayment may be a poor proxy for consumer unsophistication since it partly represents rational search in presence of rejections. Moreover, the development of improved screening technologies from AI and big data (i.e., fintech lending) could endogenously lead to more severe adverse selection in credit markets. Finally, place based policies, such as the Community Reinvestment Act, may affect equilibrium prices through endogenous search responses rather than increased credit risk.

(with Lerner, Short and Sun), 2024. Forthcoming, Journal of Political Economy

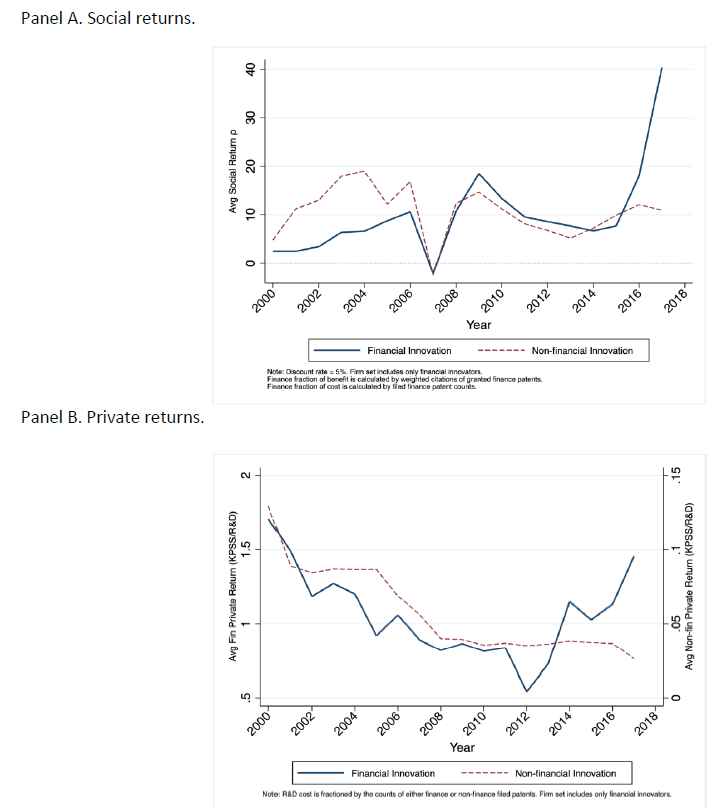

We explore the evolution of financial innovation, using 24,000 U.S. finance patents applied for and granted over last two decades. Patented financial innovations are substantial and economically important, with annual grants expanding from a few dozen in the 1990s to over 2000 in the 2010s. The subject matter of financial patents has changed, consistent with the industry’s shift towards household investors and borrowers. The surge in financial patenting was driven by information technology and other non-financial firms. The location of innovation has shifted, with banks moving activity away from states with tight financial regulation. Concurrently, high-tech regions have attracted financial innovation by payments, IT, and other non-financial firms. Analyses of the returns to financial patents suggests that the social value of these innovations are higher than their private value. We present a simple model to explain these trends. The changing dynamics of financial innovation that began in the 1980s and 1990s may have lowered the private returns to innovation and increased the desirability of patent protection for financial innovations. Regulation of banks following the financial crisis of 2007 may have raised the costs of innovation, leading them to invest less in such activity.

2023

(with Egan and Matvos), 2023. Forthcoming, Review of Economic Studies

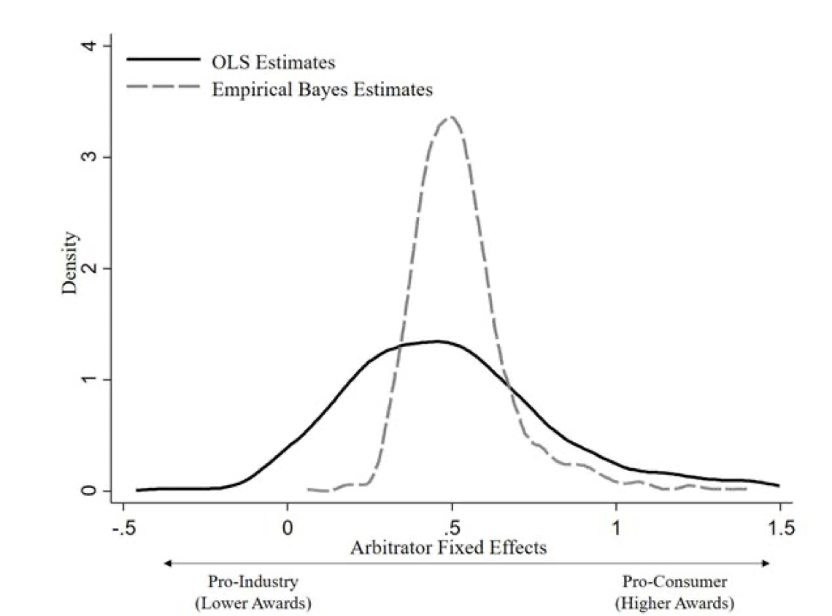

This paper studies the impact of the arbitrator selection process on consumer outcomes. Using data from consumer arbitration cases in the securities industry over the past two decades, where we observe detailed information on case characteristics, the randomly generated list of potential arbitrators presented to both parties, the selected arbitrator, and case outcomes, we establish several motivating facts. These facts suggest that firms hold an informational advantage over consumers in selecting arbitrators, resulting in industry-friendly arbitration outcomes. We then develop and calibrate a quantitative model of arbitrator selection in which firms hold an informational advantage in selecting arbitrators. Arbitrators, who are compensated only if chosen, compete with each other to be selected. The model allows us to decompose the firms’ advantage into two components: the advantage of choosing pro-industry arbitrators from a given pool, and the equilibrium pro-industry tilt in the arbitration pool that arises because of arbitrator competition. Selecting arbitrators without the input of firms and consumers would increase consumer awards by $60,000 on average relative to the current system. Forty percent of this effect arises because the pool of arbitrators skews pro-industry due to competition. Even an informed consumer cannot avoid this pro-industry equilibrium effect. Counterfactuals suggest that redesigning the arbitrator selection mechanism for the benefit of consumers hinges on whether consumers are informed. Policies intended to benefit consumers, such as increasing arbitrator compensation or giving parties more choice would benefit informed consumers but hurt the uninformed.

(with Buchak, Matvos and Piskorski), 2023. Journal of Political Economy. Vol 132 Issue 2

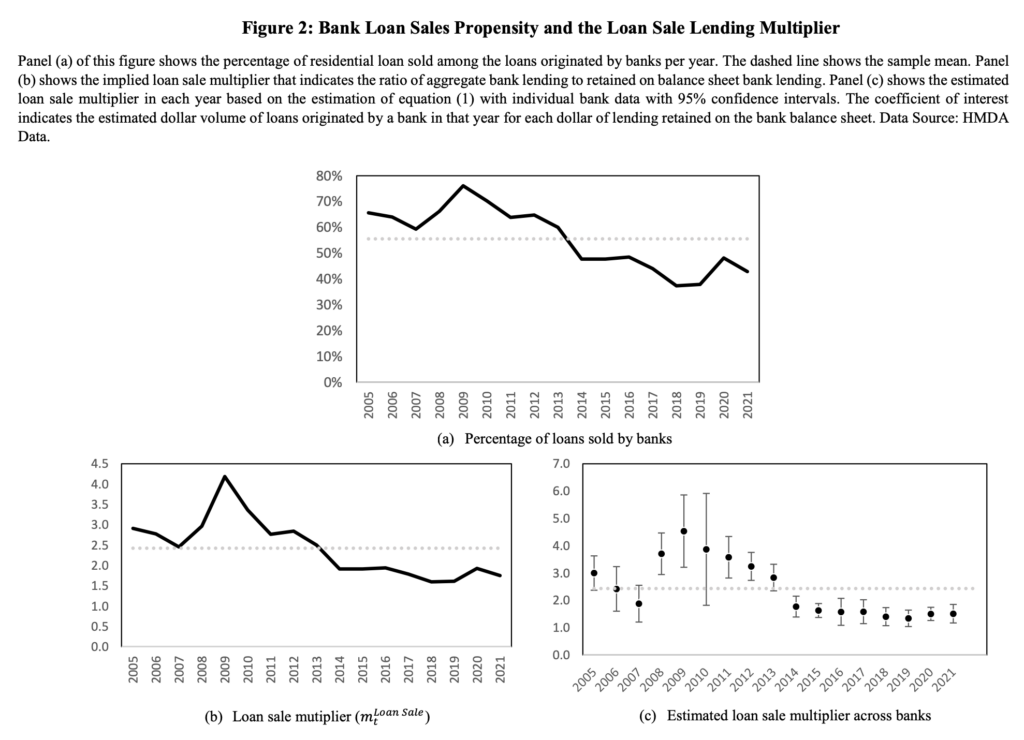

Bank balance sheet lending is commonly viewed as the predominant form of lending. We document and study two margins of adjustment that are usually absent from this view using microdata in the $10 trillion U.S. residential mortgage market. We first document the limits of the shadow bank substitution margin: shadow banks substitute for traditional—deposit-taking—banks in loans which are easily sold, but are limited from activities requiring on-balance-sheet financing. We then document the balance sheet retention margin: banks switch between traditional balance sheet lending and selling loans based on their balance sheet strength, behaving more like shadow banks following negative shocks. Motivated by this evidence, we build and estimate a workhorse structural model of the financial intermediation sector. Banks and shadow banks compete for borrowers. Banks face regulatory constraints but benefit from the ability to engage in balance sheet lending. Critically, departing from prior literature, banks can also choose to access the securitization market like shadow banks. To evaluate distributional consequences, we model a rich demand system with income and house price differences across borrowers. The model is identified using spatial pricing policies of government-sponsored entities and bunching at the regulatory threshold. We study the quantitative consequences of several policies on lending volume and pricing, bank stability, and the distribution of consumer surplus across rich and poor households. Both margins we identify significantly shape policy responses, accounting for more than $500 billion in lending volume across counterfactuals. Secondary market disruptions such as quantitative easing have significantly larger impacts on lending and redistribution than capital requirement changes once we account for these margins. We conclude that a regulatory policy analysis of the intermediation sector must incorporate the intricate industrial organization of the credit market and the equilibrium interaction of banks and shadow banks.

(with Buchak, Matvos and Piskorski), 2023. NBER Macroeconomics Annual. Vol. 38

Existing macroeconomic models focused on bank balance sheet lending are deficient because they do not account for the modern industrial organization of financial intermediation. Utilizing publicly available micro-level lending data, we investigate two increasingly significant margins of adjustment in credit markets: banks’ ability to sell loans and shadow bank activity. These adjustment margins are substantial and vary across time and regions with different incomes. We examine these margins in a parsimonious dynamic quantitative model featuring banks with balance sheet adjustment through loan sales and shadow banks. Using the calibrated model, we illustrate that these margins significantly dampen the immediate contraction following bank capital shock. Recovery is also faster, because profitable loan sales (e.g., securitization) allow banks to build capital faster and because shadow banks pick up lending slack. Failure to account for adjustment margins leads to significant errors when studying policies which rely on financial intermediation pass-through in the level of aggregate lending, its direction, and composition. Our model highlights the tension between bank balance sheet models and data. The model, which forces total lending to depend strongly on bank balance sheet health, must reconcile the weak correlation between bank capital and aggregate lending. These issues can be reconciled with now available data from bank balance sheets, overall bank lending, and aggregate lending, in conjunction with a model of modern financial intermediation.

2022

(with Egan and Matvos), 2022. Journal of Political Economy. Vol. 130 Issue 5

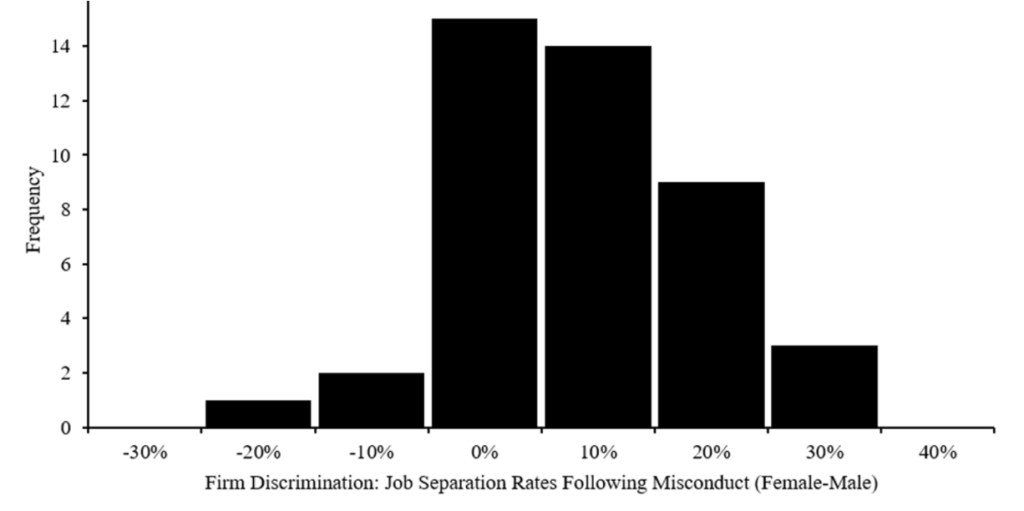

We examine gender differences in misconduct punishment in the financial advisory industry. We find evidence of a “gender punishment gap”: following an incident of misconduct, female advisers are 20% more likely to lose their jobs and 30% less likely to find new jobs relative to male advisers. Females face harsher outcomes despite engaging in misconduct that is 20% less costly and having a substantially lower propensity towards repeat offenses. The gender punishment gap in hiring and firing dissipates at firms with a greater percentage of female managers at the firm or local branch level. The gender punishment gap is not driven by gender differences in occupation (type of job, firm, market, or financial products handled), productivity, misconduct, or recidivism. We extend our analysis to explore the differential treatment of ethnic minorities and find similar patterns of “in-group” tolerance. Our evidence is inconsistent with a simple Bayesian model and suggests instead that managers are more forgiving of missteps among members of their own gender/ethnic group.

(with Agarwal, Amromin, Chomsisengphet, Landvoigt, Piskorski and V Yao), 2022. Forthcoming, Review of Economic Studies

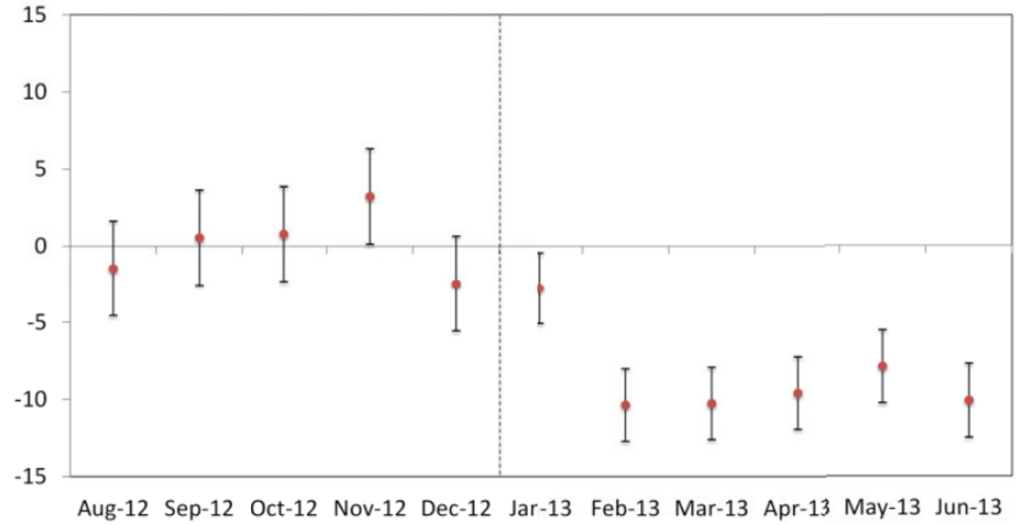

Using loan-level mortgage data merged with consumer credit records, we examine the ability of the government to impact mortgage refinancing activity and spur consumption by focusing on the Home Affordable Refinance Program (HARP). The policy relaxed housing equity constraints by extending government credit guarantee on insufficiently collateralized mortgages refinanced by intermediaries. Difference-in-difference tests based on program eligibility criteria reveal a significant increase in refinancing activity by HARP. More than three million eligible borrowers with primarily fixed-rate mortgages refinanced under HARP, receiving an average reduction of 1.45% in interest rate that amounts to $3,000 in annual savings. Durable spending by borrowers increased significantly after refinancing and regions more exposed to the program saw a relative increase in non-durable and durable consumer spending, a decline in foreclosure rates, and faster recovery in house prices. A variety of identification strategies suggest that competitive frictions in the refinancing market partly hampered the program’s impact: the take-up rate and annual savings among those who refinanced were reduced by 10% to 20%. These effects were amplified for the most indebted borrowers, the key target of the program. These findings have implications for future policy interventions, pass-through of monetary policy through household balance-sheets and design of the mortgage market.

(with Lerner), 2022. The Review of Financial Studies Vol. 35 Issue 6 Pages 2667–2704

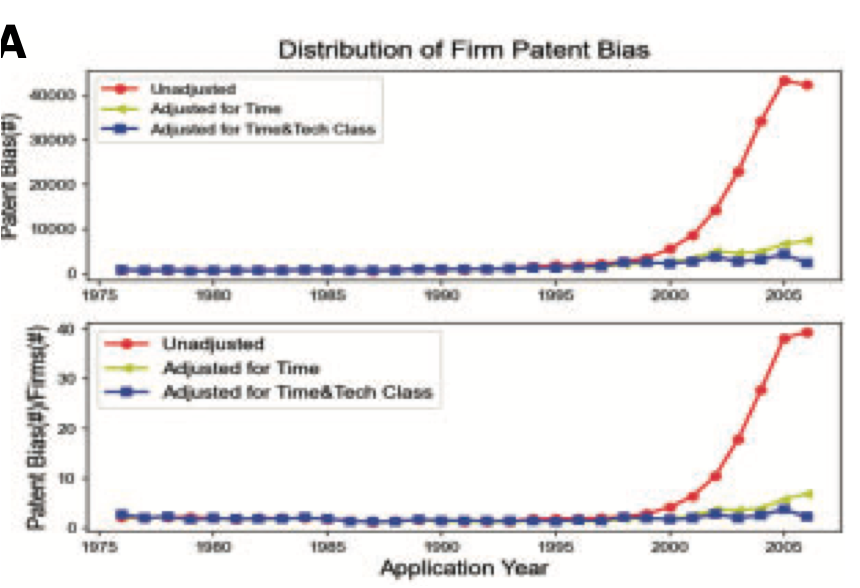

Patents and citations are powerful tools increasingly used in financial economics (and management research more broadly) to understand innovation. Biases may result, however, from the interactions between the truncation of patents and citations and the changing composition of inventors. When aggregated at the firm level, these patent and citation biases can survive popular adjustment methods and are correlated with firm characteristics. These issues can lead to problematic inferences. We provide an actionable checklist to avoid biased inferences and also suggest machine learning as a potential new way to address these problems.

(with Cherry, Jiang, Matvos and Piskorski), 2022. AEA Papers and Proceedings. Vol. 112

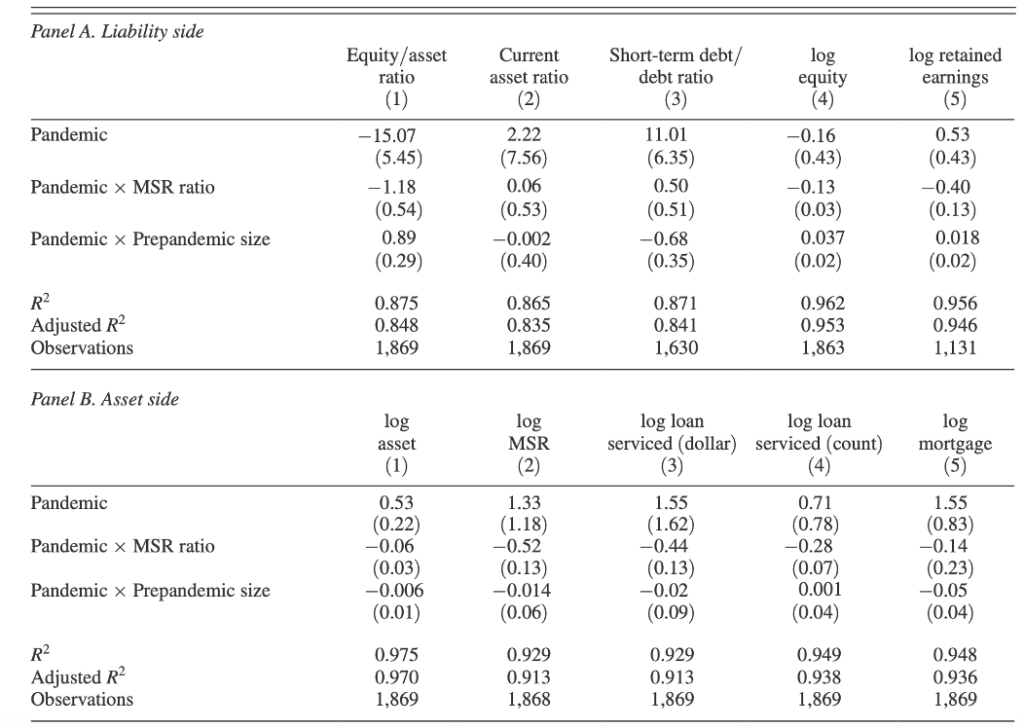

Shadow banks service a substantial portion of household debt in the United States, including half of residential mortgages. They also funded and implemented a large portion of the CARES Act-driven debt relief. Despite uniform policy and similar borrowers, shadow banks offered debt forbearance at a significantly lower (27 percent) rate compared to traditional banks. Better-capitalized shadow banks offered forbearance at a much higher rate, and those with larger exposure to servicing related liquidity shocks reduced this exposure by selling their servicing rights. We highlight the fragility of shadow bank servicing during downturns that can impede the pass-through of debt relief to households.

2021

(with Cherry, Jiang, Matvos and Piskorski), 2021. Brookings Papers on Economic Activity, Fall Edition.

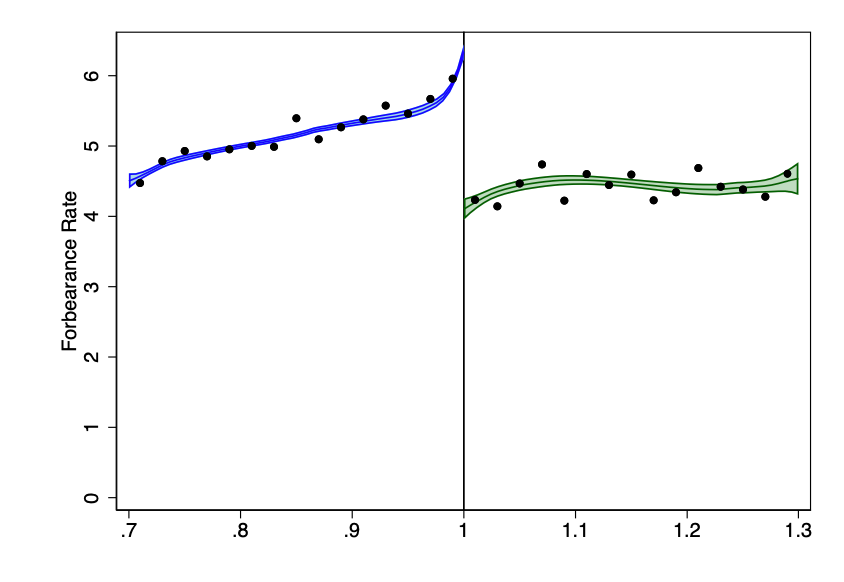

We follow a representative panel of US borrowers to study the suspension of household debt payments (debt forbearance) during the COVID-19 pandemic. Between March and October of 2020, loans worth $2 trillion entered forbearance. On average, cumulative payments missed per individual in forbearance during this period were largest for mortgage ($3,200) and auto ($430) borrowers. We estimate that more than 60 million borrowers will miss $70 billion on their debt payments by the end of 2021:Q1. This large amount of debt relief significantly dampened the household debt distress, which can help explain household delinquencies below pre-pandemic levels—a significant difference from other economic crises when delinquencies sharply increased along with unemployment. Forbearance thus may have had potentially large aggregate consequences for house prices and economic activity. Relief flows more to higher income individuals than those receiving stimulus checks, partially due to their higher debt balances: 60% of aggregate forbearance is provided to above median income borrowers. On the other hand, forbearance rates are higher among the more vulnerable populations: individuals with lower credit scores and lower incomes. Borrowers in regions with a higher likelihood of COVID-19 related economic shocks and higher shares of minorities were more likely to obtain debt relief. One third of borrowers in forbearance continued making full payments, suggesting that forbearance acts as a credit line, allowing borrowers to “draw” on payment deferral if needed. More than a quarter of total debt relief was provided by the private sector outside of the government mandates. Exploiting a discontinuity in mortgage eligibility under the CARES Act we estimate that implicit government debt relief subsidies increase the rate of forbearance by about 25%. Government and private relief follow similar patterns across income and creditworthiness, suggesting that borrower self-selection in requesting forbearance is an important determinant of debt relief incidence, and drives the distribution of relief across different population strata. Government relief is provided through private intermediaries, which differ in their propensity to supply relief, with shadow banks less likely to provide forbearance than traditional banks.

(with Benmelech and Bergman), 2021. Review of Finance

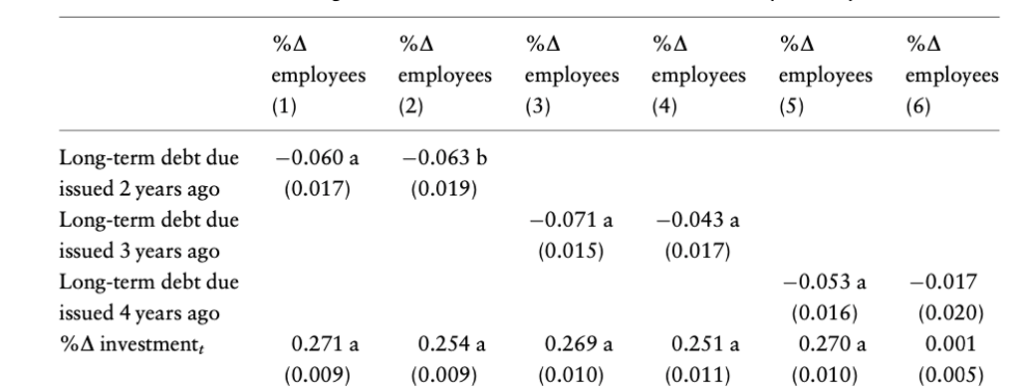

Financial market imperfections can have significant impact on employment decisions of firms. We illustrate the economic importance of this channel by showing that employment decisions are constrained by firms’ financial health and liquidity. Our main analysis uses a collage of three ‘quasi-experiments’ to trace the effects of finance on employment. The results suggest that financial constraints and the availability of credit play an important role in firm-level employment decisions, as well as aggregate unemployment outcomes.

(with Kelly, Papanikolaou and Taddy), 2021. American Economic Review: Insights

We use textual analysis of high-dimensional data from patent documents to create new indicators of technological innovation. We identify important patents based on textual similarity of a given patent to previous and subsequent work: these patents are distinct from previous work but are related to subsequent innovations. Our importance indicators correlate with existing measures of patent quality but also provide complementary information. We identify breakthrough innovations as the most important patents—those in the right tail of our measure—and construct time-series indices of technological change at the aggregate and sectoral level. Our technology indices capture the evolution of technological waves over a long time span (1840 to the present) and cover innovation by private and public firms, as well as non-profit organizations and the US government. Advances in electricity and transportation drive the index in the 1880s; chemicals and electricity in the 1920s and 1930s; and computers and communication in the post-1980s.

(with Piskorski), 2021. Forthcoming, Journal of Financial Economics.

We follow a representative panel of millions of consumers in the U.S. from 2007 to 2017 and document several facts on the long-term effects of the Great Recession. There were about six million foreclosures in the ten-year period after Lehman’s collapse. Owners of multiple homes accounted for 25% of these foreclosures, while comprising only 13% of the market. Foreclosures displaced homeowners, with most of them moving at least once. Only a quarter of foreclosed households regained homeownership, taking an average four years to do so. Despite massive stimulus and debt relief policies, recovery was slow and varied dramatically across regions. House prices, consumption and unemployment remain below pre-crisis levels in about half of the zip codes in the U.S. Regions that recovered to pre-crisis levels took on average four to five years from the depths of the Great Recession. Regional variation in the extent and speed of recovery is strongly related to frictions affecting the pass-through of lower interest rates and debt relief to households including mortgage contract rigidity, refinancing constraints, and the organizational capacity of intermediaries to conduct loan renegotiations. A simple counterfactual based on our estimates suggest that, regardless of the narratives of the causes of housing boom and bust, alleviating these frictions could have reduced the relative foreclosure rate by more than half and resulted in up to twice as fast recovery of house prices, consumption, and employment. Our findings have implications for mortgage market design, monetary policy pass-through, and macro-prudential and housing policy interventions.

2020

2019

(with Agarwal, Qian and Zhang), 2019. Journal of Financial Economics, Vol 137, Issue 2, 430-450

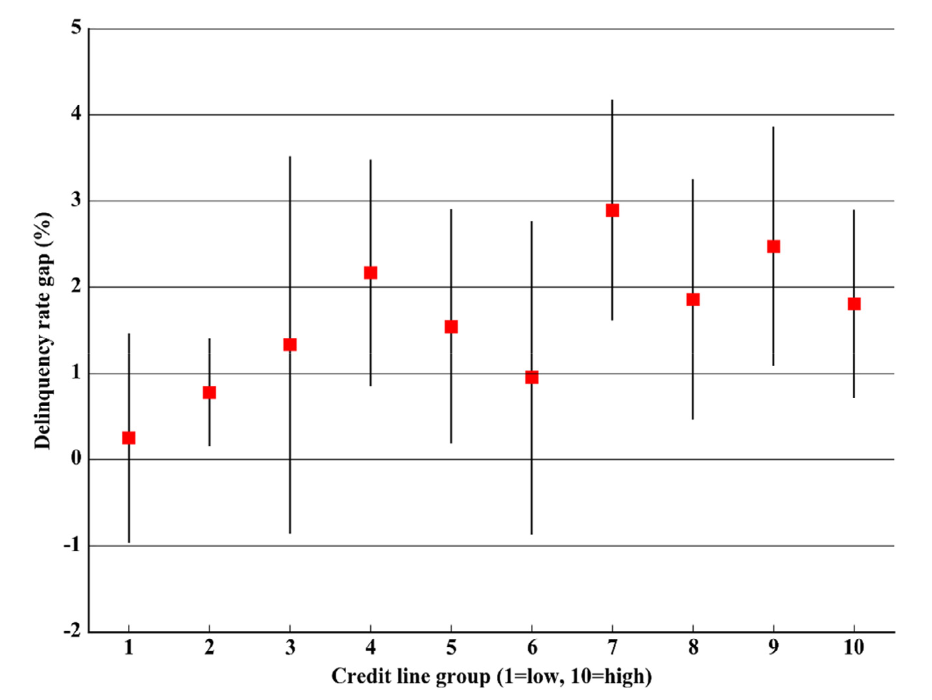

Using a comprehensive sample of credit card data from a leading Chinese bank, we find that government bureaucrats receive 16% higher credit lines than non-bureaucrats with similar income and demographics, but their accounts experience a significantly higher likelihood of delinquency and debt forgiveness. These patterns are concentrated among bureaucrats with greater power and located in more “corrupt” cities. Areas associated with greater credit provision to bureaucrats open more branches and receive more deposits from the local government. Using staggered crackdowns of provincial-level political officials as exogenous shocks to the risk of corruption investigation, we find that the new credit cards originated to bureaucrats do not enjoy a credit line premium, and bureaucrats’ delinquency and reinstatement rates are no higher than those of non-bureaucrats in the treated provinces during the post-crackdown period. We use our estimates to infer the size of corruption and explore the impact on aggregate economic outcomes.

2018

(with Buchak, Matvos and Piskorski), Journal of Financial Economics, 2018, Vol 130, Issue 3, 453-483.

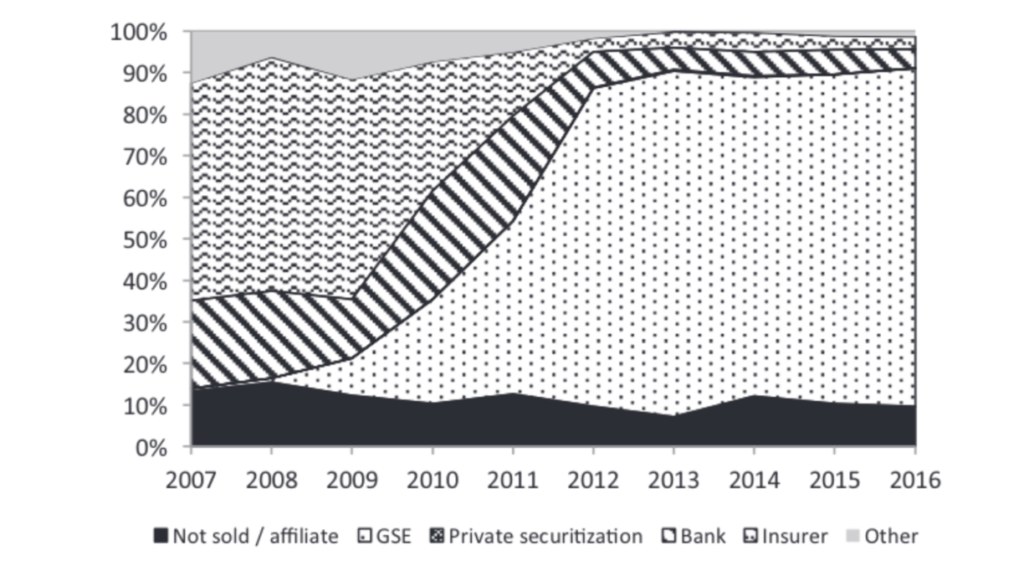

Shadow bank market share in residential mortgage origination nearly doubled from 2007 to 2015, with particularly dramatic growth among online “fintech” lenders. We study how two forces, regulatory differences and technological advantages, contributed to this growth. Difference in difference tests exploiting geographical heterogeneity induced by four specific increases in regulatory burden–capital requirements, mortgage servicing rights, mortgage-related lawsuits, and the movement of supervision to Office of Comptroller and Currency following closure of the Office of Thrift Supervision–all reveal that traditional banks contracted in markets where they faced more regulatory constraints; shadow banks partially filled these gaps. Relative to other shadow banks, fintech lenders serve more creditworthy borrowers and are more active in the refinancing market. Fintech lenders charge a premium of 14–16 basis points and appear to provide convenience rather than cost savings to borrowers. They seem to use different information to set interest rates relative to other lenders. A quantitative model of mortgage lending suggests that regulation accounts for roughly 60% of shadow bank growth, while technology accounts for roughly 30%.

JFE Jensen Award for Corporate Finance and Organizations (Second Prize).

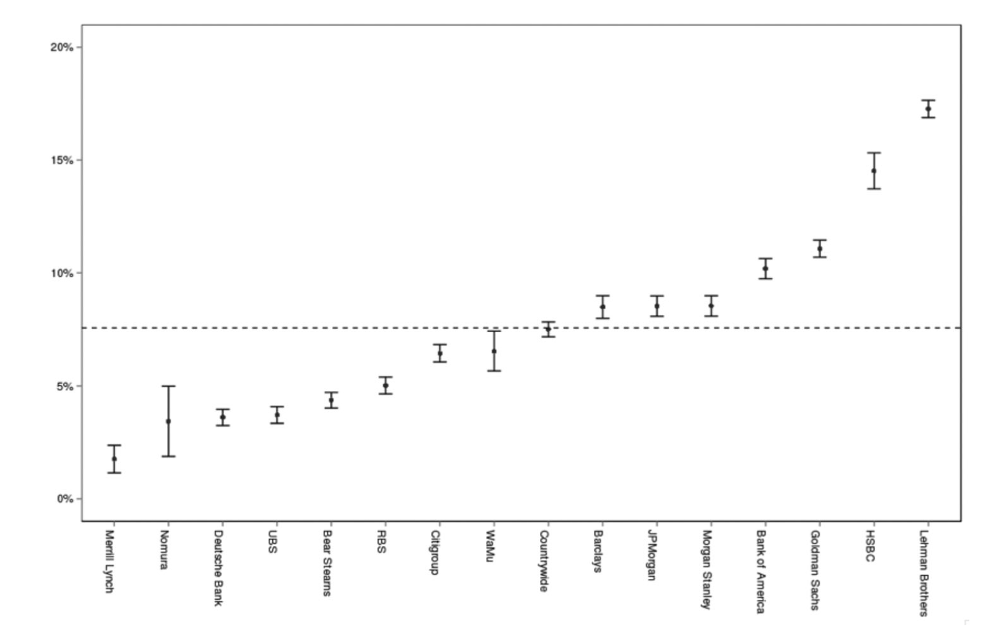

(with Egan and Matvos), Journal of Political Economy, 2018, Vol 127, Issue 1, 233-295.

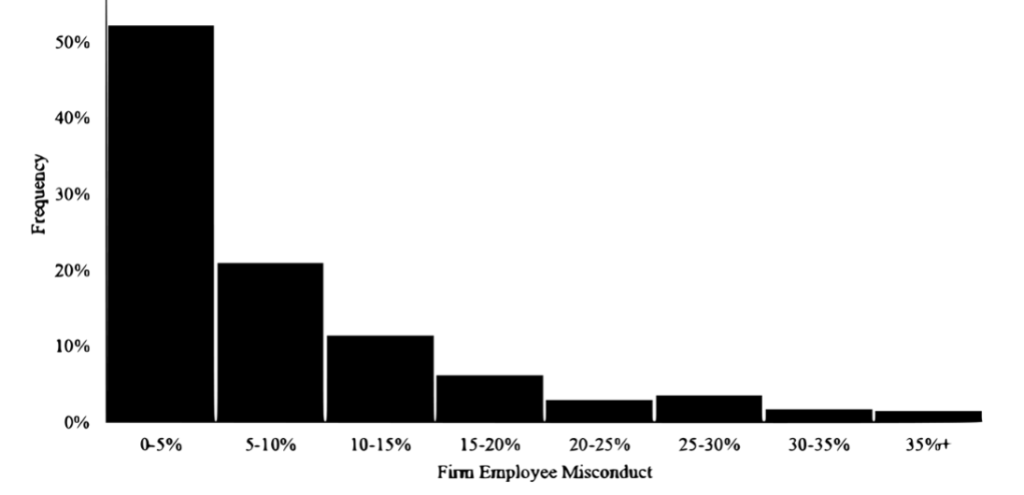

We construct a novel database containing the universe of financial advisers in the United States from 2005 to 2015, representing approximately 10% of employment of the finance and insurance sector. We provide the first large-scale study that documents the economy-wide extent of misconduct among financial advisers and the associated labor market consequences of misconduct. Seven percent of advisers have misconduct records, and this share reaches more than 15% at some of the largest advisory firms. Roughly one third of advisers with misconduct are repeat offenders. Prior offenders are five times as likely to engage in new misconduct as the average financial adviser. Firms discipline misconduct: approximately half of financial advisers lose their jobs after misconduct. The labor market partially undoes firm-level discipline by rehiring such advisers. Firms that hire these advisers also have higher rates of prior misconduct themselves, suggesting “matching on misconduct.” These firms are less desirable and offer lower compensation. We argue that heterogeneity in consumer sophistication could explain the prevalence and persistence of misconduct at such firms. Misconduct is concentrated at firms with retail customers and in counties with low education, elderly populations, and high incomes. Our findings are consistent with some firms “specializing” in misconduct and catering to unsophisticated consumers, while others use their clean reputation to attract sophisticated consumers.

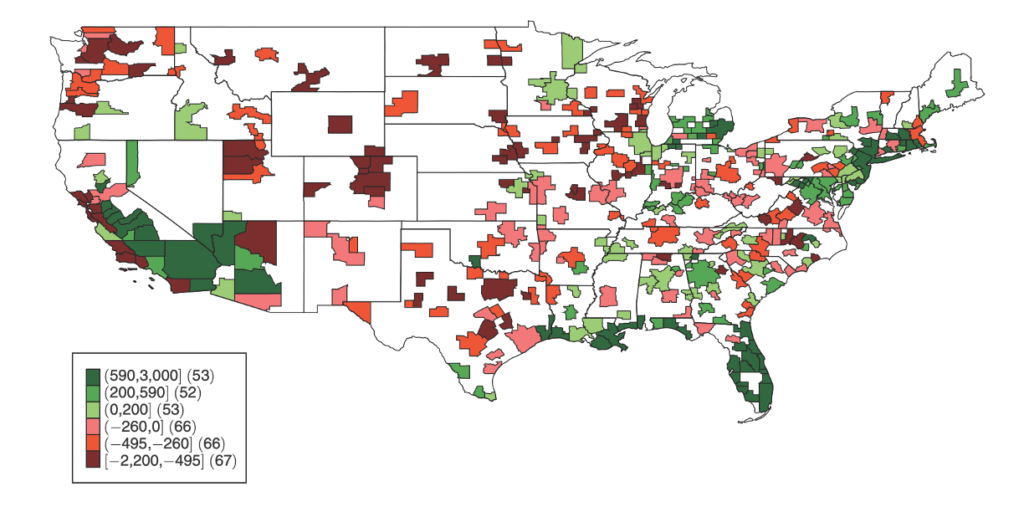

(with Piskorksi), 2018. Brookings Papers on Economic Activity, Spring Edition.

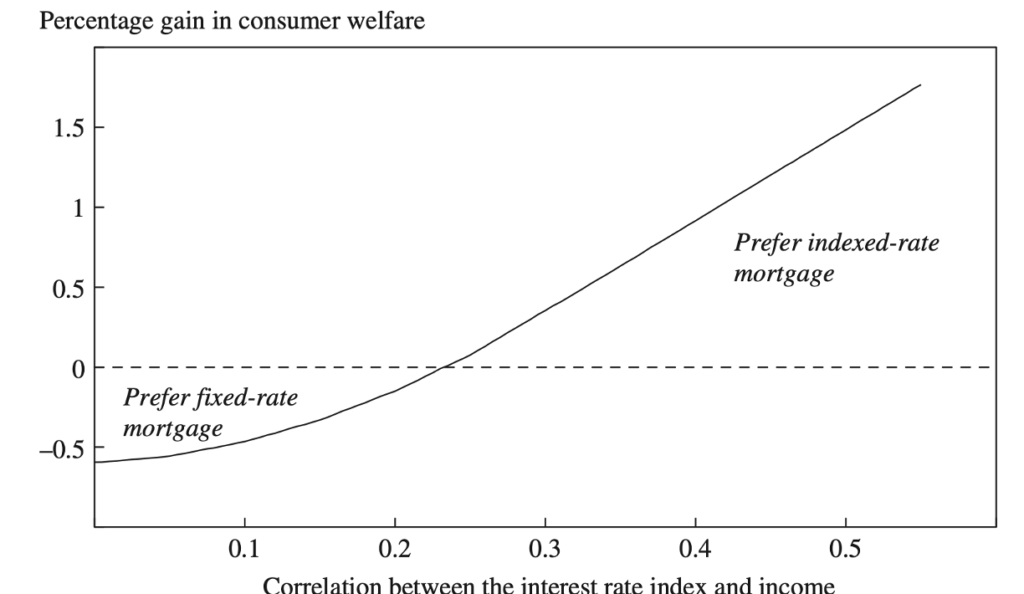

The rigidity of mortgage contracts and a variety of frictions in the design of the market and the intermediation sector hindered efforts to restructure or refinance household debt in the aftermath of the financial crisis. In this paper, we focus on understanding the design and implementation challenges of ex ante and ex post debt relief solutions that are aimed at a more efficient sharing of aggregate risk between borrowers and lenders. Using a simple framework that builds on the mortgage design literature, we illustrate that ex ante–designed, automatically indexed mortgages and policies can facilitate a quick implementation of debt relief during a crisis. However, the welfare benefits of such solutions are substantially reduced if there are errors in understanding the underlying structure of income and housing risk and their relation to the indexes on which these solutions are based. Empirical evidence reveals significant spatial heterogeneity and the time-varying nature of the distribution of economic conditions, which pose a significant challenge to the effective ex ante design of such solutions. The design of ex post debt relief policies can be more easily fine-tuned to the specific realization of economic risk. However, the presence of various implementation frictions and their spatial heterogeneity can significantly hamper their effectiveness. Consequently, we argue that effective mortgage market design will likely involve a combination of ex ante and ex post debt relief solutions, with state contingencies. We conclude by discussing the potential gains—which can be large, given significant regional heterogeneity—from tying mortgage terms and policies to local indicators, as well as mechanisms that may alleviate the adverse effects of ex post implementation frictions.

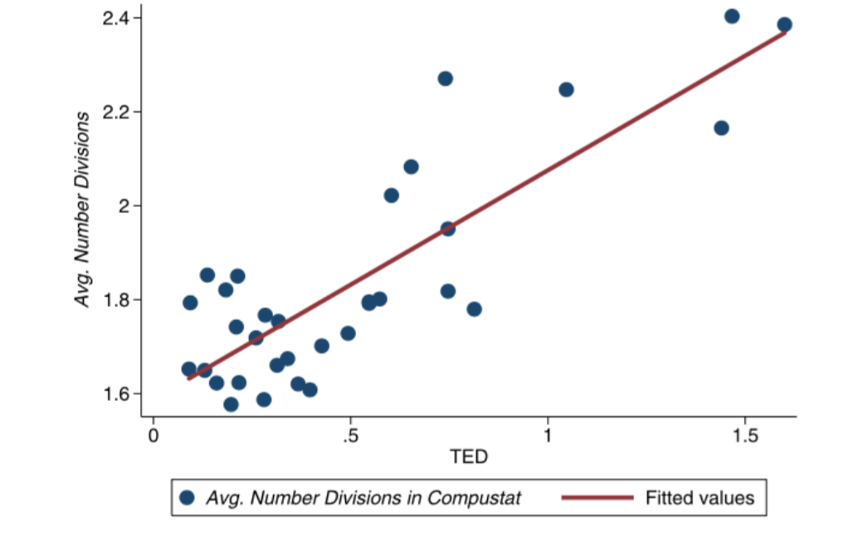

(with Matvos and Silva), Journal of Financial Economics, 2018, Vol 127, Issue 1, 21-50.

We find new facts that relate the evolution of firm scope to the changing frictions in external capital markets over the last three decades. We find that large, diversified publicly traded firms increase their scope during times of high external capital market frictions, such as in the recent Great Recession. Moreover, during these times firms diversify their investment needs and cash flow across industries. We also find similar phenomena outside diversified public firms. Examining the mergers and acquisitions activity of stand-alone and diversified private firms, we uncover similar patterns. In aggregate data, we find that the composition of mergers shifts from focused to diversifying and back with changes in external market conditions. Our evidence is broadly consistent with the notion that firms diversify their scope in response to tightening in external capital markets.

2017

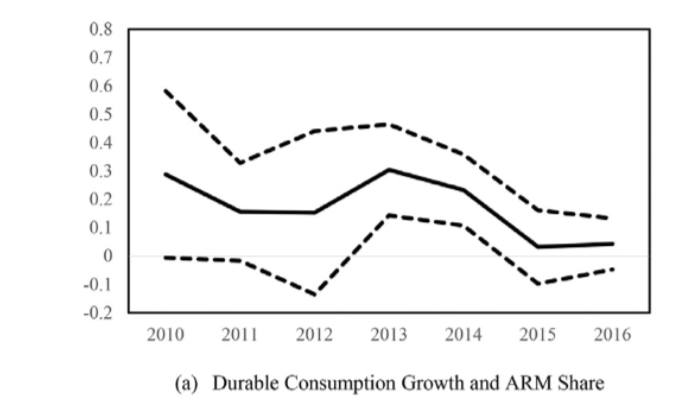

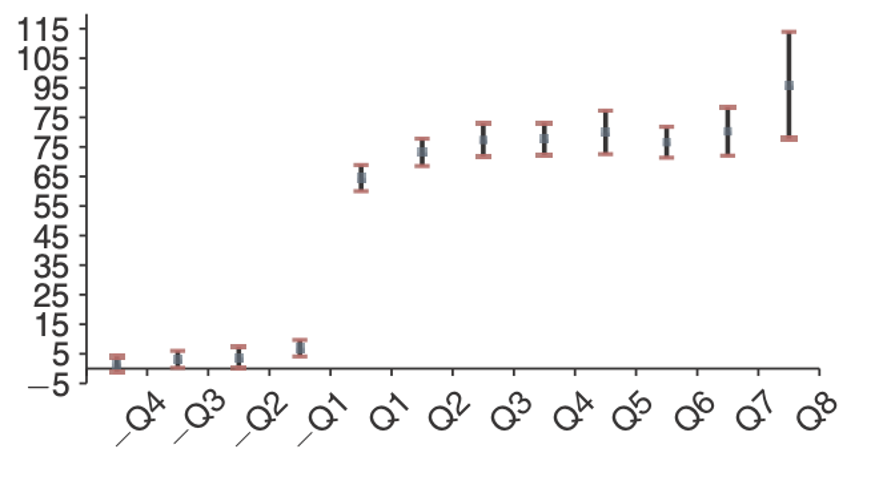

(with Di Maggio, Kermani, Keys, Piskorski, Ramcharan, and Yao), American Economic Review, 2017, Vol 107, Issue 11, 3550-3588.

Exploiting variation in the timing of resets of adjustable-rate mortgages (ARMs), we find that a sizable decline in mortgage payments (up to 50 percent) induces a significant increase in car purchases (up to 35 percent). This effect is attenuated by voluntary deleveraging. Borrowers with lower incomes and housing wealth have significantly higher marginal propensity to consume. Areas with a larger share of ARMs were more responsive to lower interest rates and saw a relative decline in defaults and an increase in house prices, car purchases, and employment. Household balance sheets and mortgage contract rigidity are important for monetary policy pass-through.

Note: this is a combined version of working papers Monetary Policy Pass-Through: Household Consumption and Voluntary Deleveraging by M. Di Maggio, A. Kermani and R. Ramcharan previously Revise & Resubmit at American Economic Review and Mortgage Rates, Household Balance Sheets, and the Real Economy by B. Keys, T. Piskorski, A. Seru, and V. Yao previously Revise and Resubmit at Journal of Political Economy

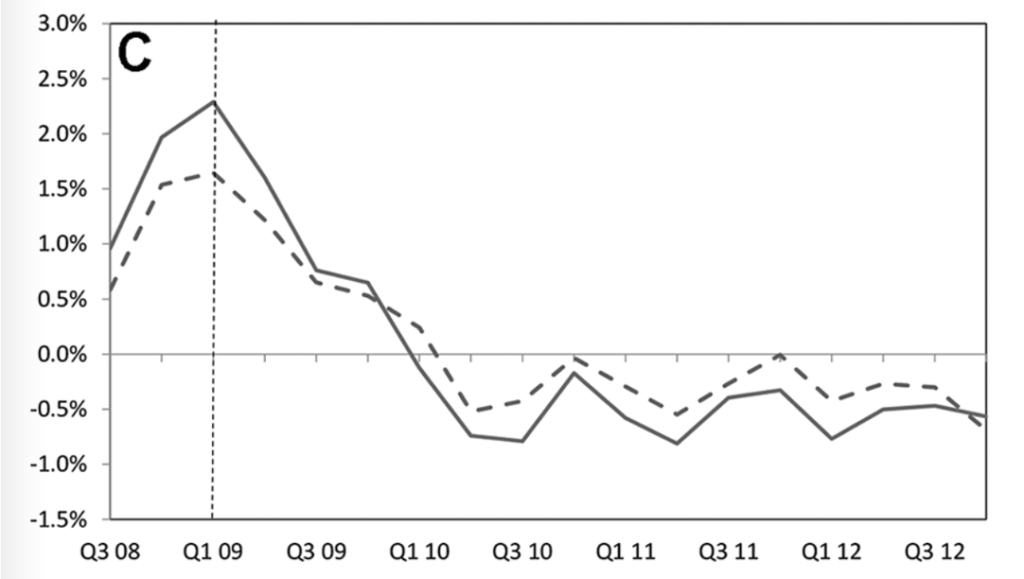

(with S Agarwal, G Amromin, I Ben-David, S Chomsisengphet and T Piskorski), Journal of Political Economy, 2017.

We evaluate the effects of the 2009 Home Affordable Modification Program (HAMP) that provided intermediaries with sizeable financial incentives to renegotiate mortgages. HAMP increased intensity of renegotiations and prevented substantial number of foreclosures but reached just one-third of its targeted indebted households. This shortfall was in large part due to low renegotiation intensity of a few large intermediaries and was driven by intermediary-specific factors. Exploiting regional variation in the intensity of program implementation by intermediaries suggests that the program was associated with lower rate of foreclosures, consumer debt delinquencies, house price declines, and an increase in durable spending.

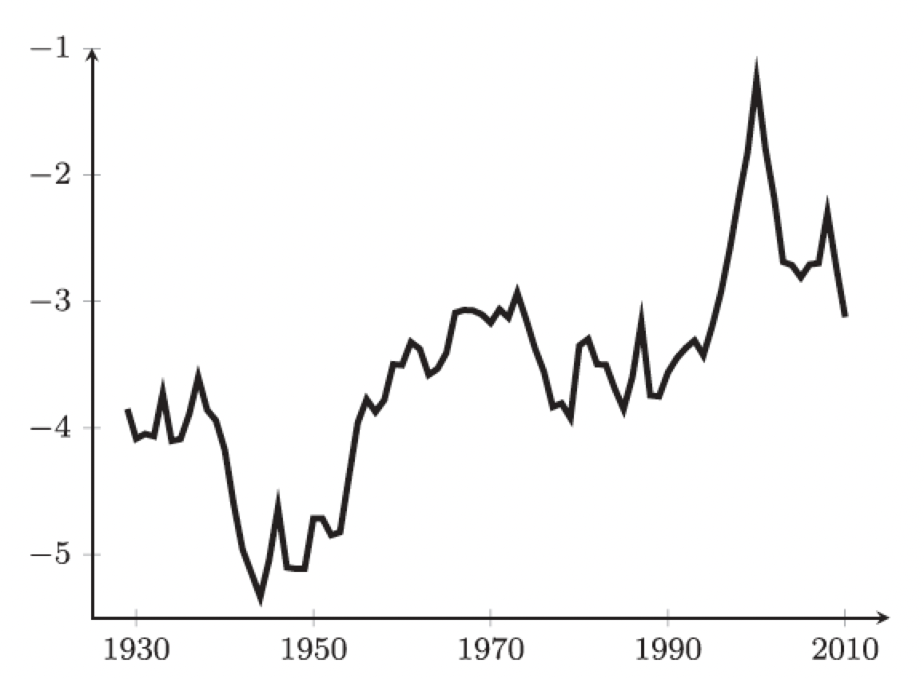

(with L Kogan, D Papanikolaou and N Stoffman), Quarterly Journal of Economics, 2017, Vol 132, Issue 2, 665-712.

We propose a new measure of the economic importance of each innovation. Our measure uses newly collected data on patents issued to US firms in the 1926 to 2010 period, combined with the stock market response to news about patents. Our patent- level estimates of private economic value are positively related to the scientific value of these patents, as measured by the number of citations that the patent receives in the future. Our new measure is associated with substantial growth, reallocation and creative destruction, consistent with the predictions of Schumpeterian growth models. Aggregating our measure suggests that technological innovation accounts for significant medium-run fluctuations in aggregate economic growth and TFP. Our measure contains additional information relative to citation-weighted patent counts; the relation between our measure and firm growth is considerably stronger. Importantly, the degree of creative destruction that is associated with our measure is higher than previous estimates, confirming that it is a useful proxy for the private valuation of patents.

Crowell Memorial Prize, Panagora Asset Management.

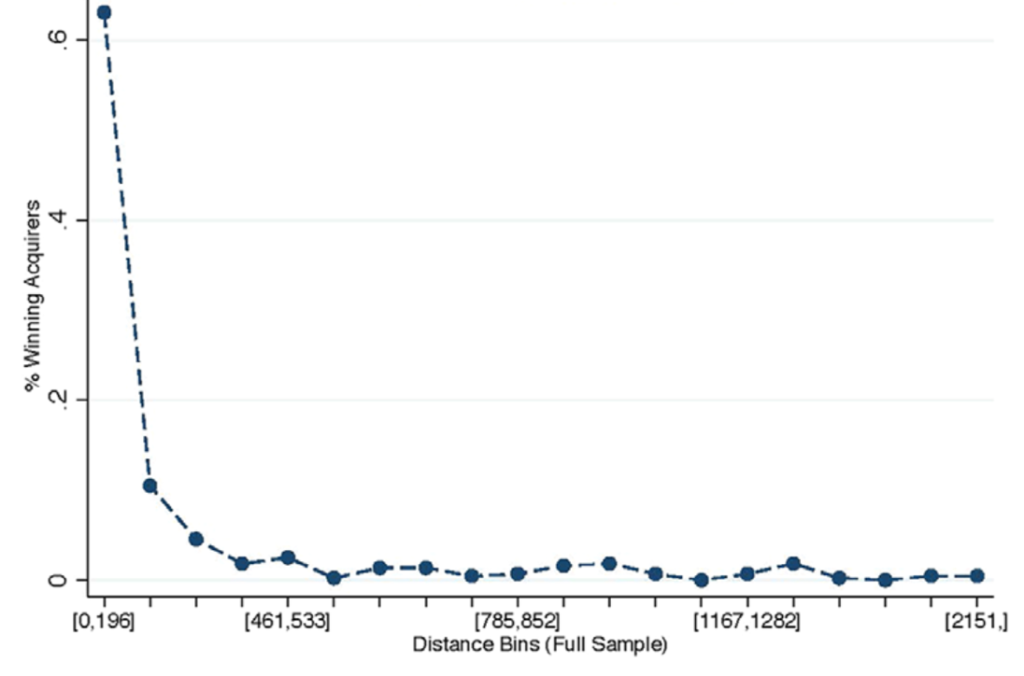

(with J Granja and G Matvos), Journal of Finance, 2017, Vol 72, Issue 4, 1723-1784.

We show that the allocation of failed banks in the Great Recession was likely distorted because potential acquirers of these banks were poorly capitalized. We illustrate this phenomenon within a model of auctions with budget constraints. In our model poor capitalization of some potential acquirers drives a wedge between their willingness to pay and the ability to pay for a failed bank. Using our framework, we infer three characteristics that drive potential acquirers’ willingness to pay for a failed bank in the data: geographic proximity, bank specialization, and increased market concentration. Consistent with predictions of our model, we find that low capitalization of potential acquirers decreases their ability to acquire a failed bank. Finally, we show that the wedge between potential acquirers’ willingness and ability to pay distorts the allocation of failed banks. The costs of this misallocation are substantial, as measured by the additional resolution costs of the FDIC. These findings have direct implications for the design of the bank resolution process.

2016

(with E Hurst, B Keys and J Vavra), American Economic Review, 2016, Vol 106, Issue 10, 2982-3028.

Regional shocks are an important feature of the U.S. economy. Households’ ability to self-insure against these shocks depends on how they affect local interest rates. In the United States, most borrowing occurs through the mortgage market and is influenced by the presence of government-sponsored enterprises (GSEs). We establish that despite large regional variation in predictable default risk, GSE mortgage rates for otherwise identical loans do not vary spatially. In contrast, the private market does set interest rates that vary with local risk. We use a spatial model of collateralized borrowing to show that the national interest rate policy substantially affects welfare by redistributing resources across regions.

(with U Gurun and G Matvos), Journal of Finance, 2016.

Using information on advertising and mortgages originated by subprime lenders, we study whether advertising helped consumers find cheaper mortgages. Lenders that advertise more within a region sell more expensive mortgages, measured as the excess rate of a mortgage after accounting for borrower, contract, and regional characteristics. These effects are stronger for mortgages sold to less sophisticated consumers. We exploit regional variation in mortgage advertising induced by the entry of Craigslist and other tests to demonstrate that these findings are not spurious. Analyzing advertising content reveals that initial/introductory rates are frequently advertised in a salient fashion, where reset rates are not.

2015

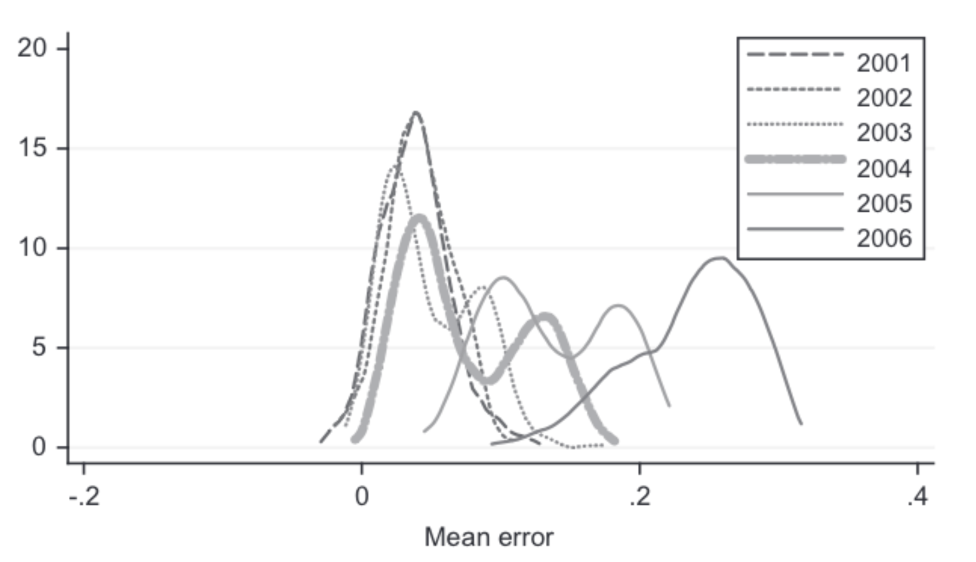

(with T Piskorski and J Witkin), Journal of Finance, 2015

We contend that buyers received false information about the true quality of assets in contractual disclosures by intermediaries during the sale of mortgages in the $2 trillion non-agency market. We construct two measures of misrepresentation of asset quality — misreported occupancy status of borrower and misreported second liens — by comparing the characteristics of mortgages disclosed to the investors at the time of sale with actual characteristics of these loans at that time that are available in a dataset matched by a credit bureau. About one out of every ten loans has one of these misrepresentations. These misrepresentations are not likely to be an artifact of matching error between datasets that contain actual characteristics and those that are reported to investors. At least part of this misrepresentation likely occurs within the boundaries of the financial industry (i.e., not by borrowers). The propensity of intermediaries to sell misrepresented loans increased as the housing market boomed, peaking in 2006. These misrepresentations are costly for investors, as ex post delinquencies of such loans are more than 60% higher when compared with otherwise similar loans. Lenders seem to be partly aware of this risk, charging a higher interest rate on misrepresented loans relative to otherwise similar loans, but the interest rate markup on misrepresented loans does not fully reflect their higher default risk. Using measures of pricing used in the literature, we find no evidence that these misrepresentations were priced in the securities at their issuance. A significant degree of misrepresentation exists across all reputable intermediaries involved in sale of mortgages. The propensity to misrepresent seems to be largely unrelated to measures of incentives for top management, to quality of risk management inside these firms or to regulatory environment in a region. Misrepresentations on just two relatively easy-to-quantify dimensions of asset quality could result in forced repurchases of mortgages by intermediaries up to $160 billion.

AQR Insight Award [Distinguished Paper]

(with U Rajan and V Vig), Journal of Financial Economics, 2015.

Statistical default models, widely used to assess default risk, fail to account for a change in the relations between different variables resulting from an underlying change in agent behavior. We demonstrate this phenomenon using data on securitized subprime mortgages issued in the period 1997–2006. As the level of securitization increases, lenders have an incentive to originate loans that rate high based on characteristics that are reported to investors, even if other unreported variables imply a lower borrower quality. Consistent with this behavior, we find that over time lenders set interest rates only on the basis of variables that are reported to investors, ignoring other credit-relevant information. As a result, among borrowers with similar reported characteristics, over time the set that receives loans becomes worse along the unreported information dimension. This change in lender behavior alters the data generating process by transforming the mapping from observables to loan defaults. To illustrate this effect, we show that the interest rate on a loan becomes a worse predictor of default as securitization increases. Moreover, a statistical default model estimated in a low securitization period breaks down in a high securitization period in a systematic manner: it underpredicts defaults among borrowers for whom soft information is more valuable. Regulations that rely on such models to assess default risk could, therefore, be undermined by the actions of market participants.

2014

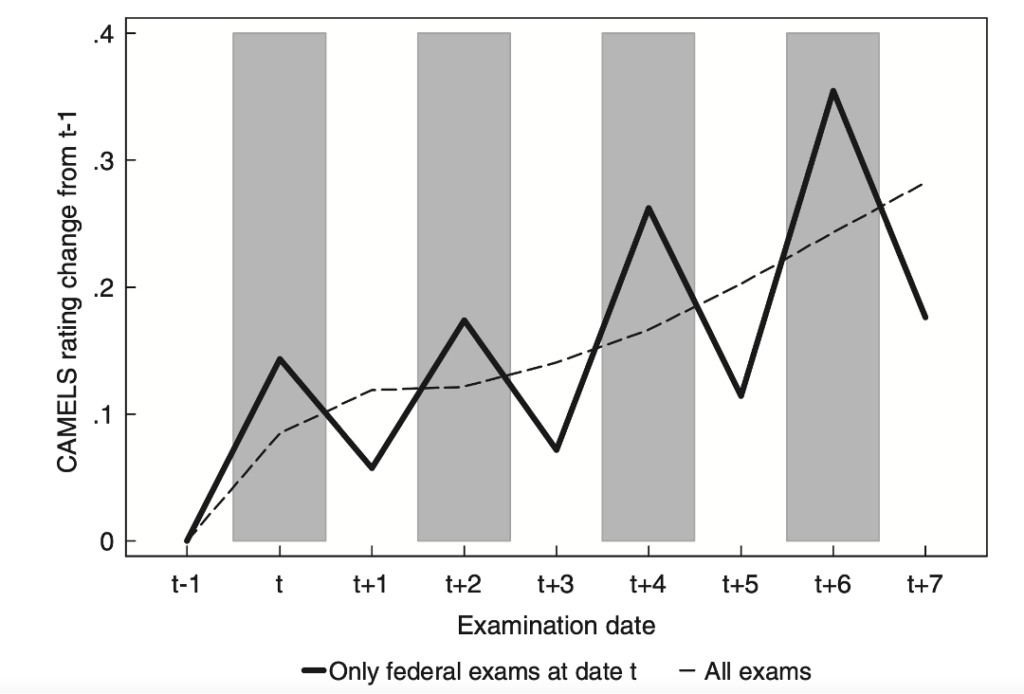

(with S Agarwal, D Lucca and F Trebbi). Quarterly Journal of Economics, 2014.

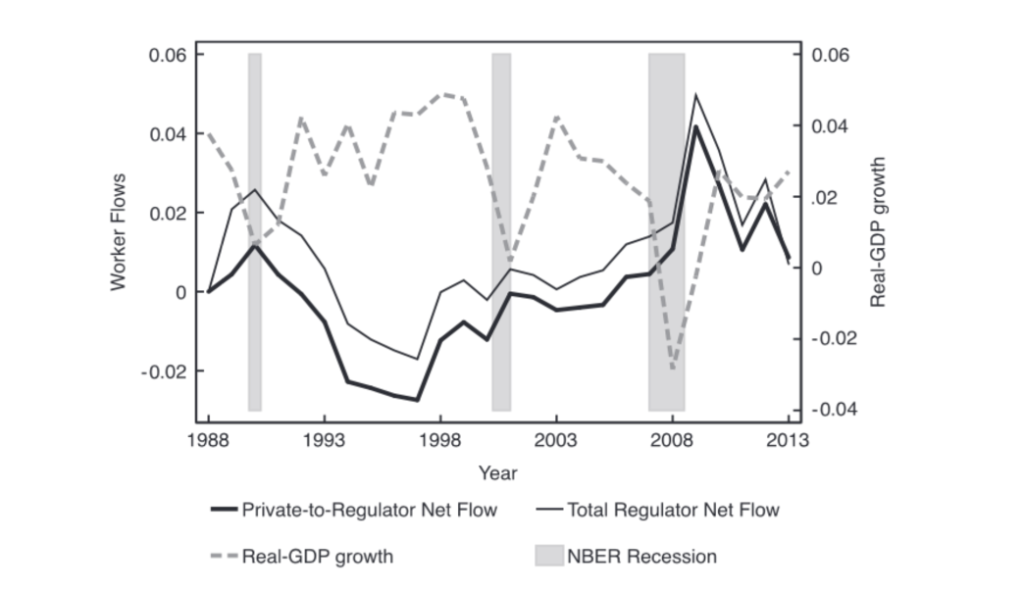

This paper traces career transitions of federal and state U.S. banking regulators from a large sample of publicly available curricula vitae, and provides basic facts on worker flows between the regulatory and private sector resulting from the revolving door. We find strong countercyclical net worker flows into regulatory jobs, driven largely by higher gross outflows into the private sector during booms. These worker flows are also driven by state-specific banking conditions as measured by local banks’ profitability, asset quality and failure rates. The regulatory sector seems to experience a retention challenge over time, with shorter regulatory spells for workers, and especially those with higher education. Evidence from cross-state enforcement actions of regulators shows gross inflows into regulation and gross outflows from regulation are both higher during periods of intense enforcement, though gross outflows are significantly smaller in magnitude. These results appear inconsistent with a “quid-pro-quo” explanation of the revolving door, but consistent with a “regulatory schooling” hypothesis.

(with D Lucca and F Trebbi), Journal of Monetary Economics, 2014.

This paper traces career transitions of federal and state U.S. banking regulators from a large sample of publicly available curricula vitae, and provides basic facts on worker flows between the regulatory and private sector resulting from the revolving door. We find strong countercyclical net worker flows into regulatory jobs, driven largely by higher gross outflows into the private sector during booms. These worker flows are also driven by state-specific banking conditions as measured by local banks’ profitability, asset quality and failure rates. The regulatory sector seems to experience a retention challenge over time, with shorter regulatory spells for workers, and especially those with higher education. Evidence from cross-state enforcement actions of regulators shows gross inflows into regulation and gross outflows from regulation are both higher during periods of intense enforcement, though gross outflows are significantly smaller in magnitude. These results appear inconsistent with a “quid-pro-quo” explanation of the revolving door, but consistent with a “regulatory schooling” hypothesis.

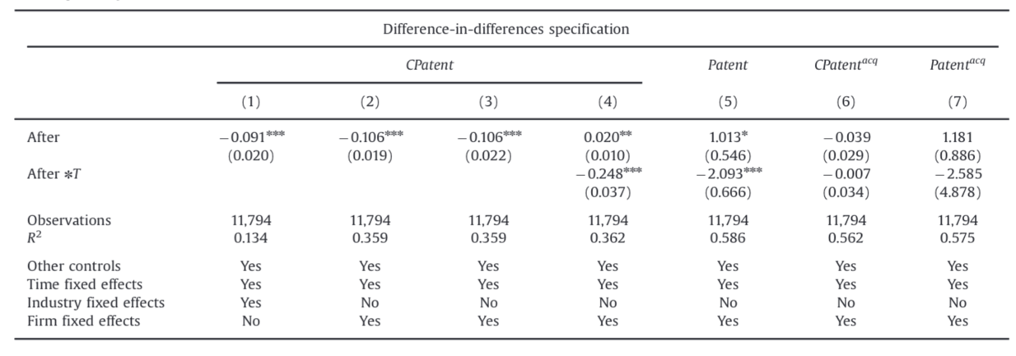

Journal of Financial Economics, 2014.

This paper examines the impact of the conglomerate form on the scale and novelty of corporate R&D activity. I exploit a quasi-experiment involving failed mergers to generate exogenous variation in acquisition outcomes of target firms. A difference-in-difference estimation reveals that, relative to failed targets, firms acquired in a diversifying mergers produce both a smaller number of innovations and also less novel innovations, where innovations are measured using patent-based metrics. The treatment effect is amplified if the acquiring conglomerate operates a more active internal capital market and is largely driven by inventors becoming less productive after the merger rather than inventor exits. Concurrently, acquirers move R&D activity outside the boundary of the firm via the use of strategic alliances and joint-ventures. There is complementary evidence that conglomerates with more novel R&D tend to operate with decentralized R&D budgets. These findings suggests that conglomerate organizational form affects the allocation and productivity of resources.

Previously titled: Do Conglomerates Stifle Innovation?

JFE Jensen Award for Corporate Finance and Organizations (First Prize).

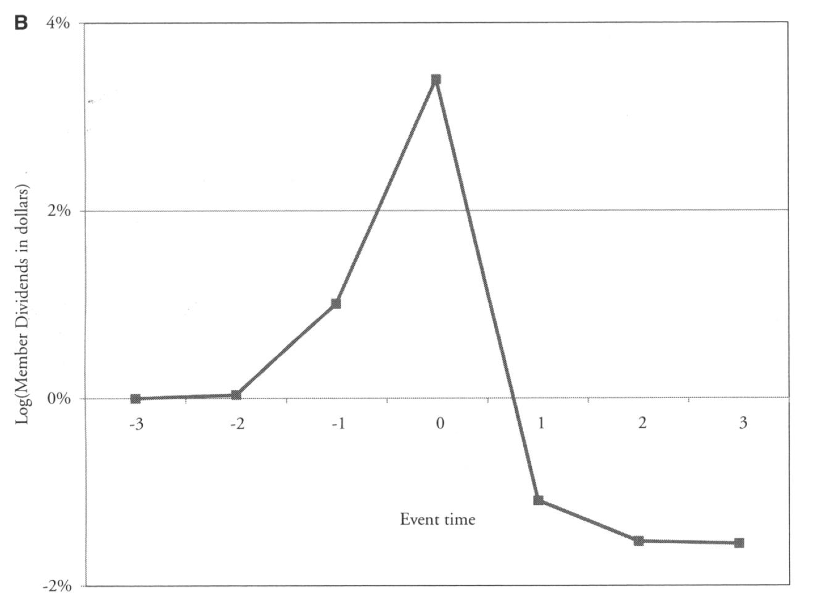

(with R Gopalan and V Nanda), Review of Financial Studies, 2014.

This paper argues that the organization of an internal capital market can influence an affiliated firm’s dividend policy. The intuition is developed in a model in which business groups — several independent firms owned and controlled by a family — operate an internal capital market that uses dividends to lower their cost of external finance: insiders distribute dividends from cash-rich firms and use their share of the payout to finance investments in other affiliated firms. Employing a rich firm-level panel data of business group firms across 22 countries spanning Asia and Europe, we test and find empirical support for this channel. Dividend payments by an affiliated firm are positively correlated with equity financed investments by other firms in its group. This relationship largely accounts for the propensity of affiliated firms to pay more dividends than their unaffiliated counterparts in these countries. A placebo test on ‘pseudo’ affiliated firms confirms these are not spurious correlations. These results are corroborated by exploiting a quasi-experiment that uses changes in import tariff policy to generate variation in investment opportunities across different industries: a positive shock to the investment opportunity of an affiliated firm is propagated to the dividend policies of unaffected firms in its group.

(with G Matvos), Review of Financial Studies, 2014.

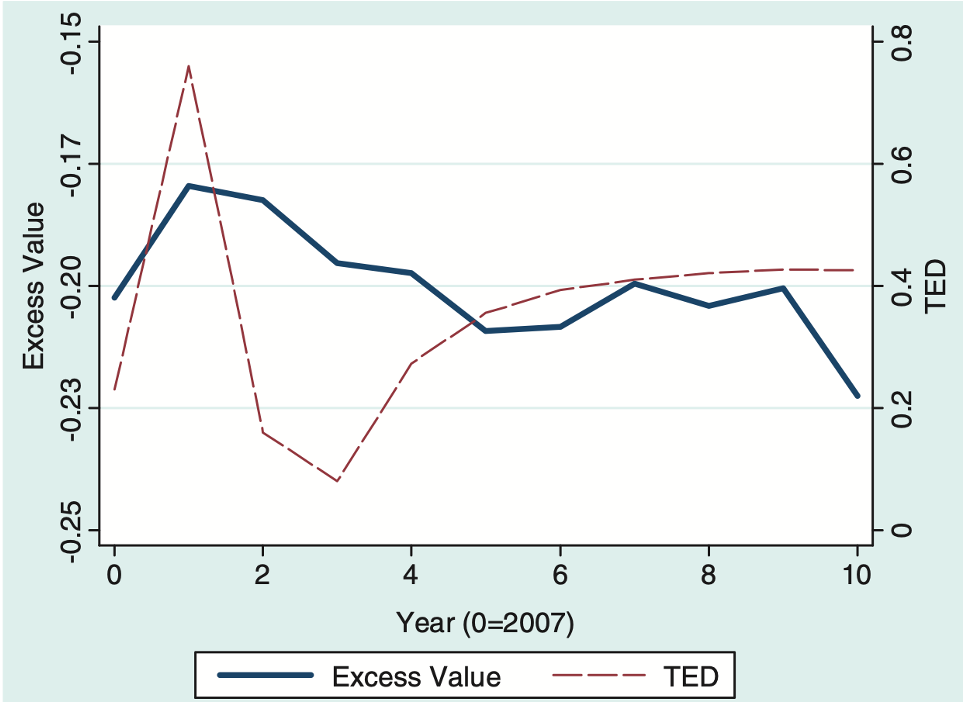

When external capital markets are stressed they may not reallocate resources between firms. We show that resource allocation within firms’ internal capital markets provides an important force countervailing financial market dislocation. Using data on U.S. conglomerates we empirically verify that firms shift resources between industries in response to shocks to the financial sector. We estimate a structural model of internal capital markets to separately identify and quantify the forces driving the reallocation decision and illustrate how these forces interact with external capital market stress. The frictions in internal capital markets drive a large wedge between productivity and investment: the weaker (stronger) division obtains too much (little) capital, as though it is 12 (9) percent more (less) productive than it really is. The cost of accessing external capital funds quadruples during extreme financial market dislocations, making resource allocation within firms significantly cheaper. The estimated model allows us to simulate the propagation of the 2007/2008 financial market dislocation. The counterfactual out of sample simulated data is remarkably consistent with the actual data and shows that improved resource allocation in internal capital markets offset financial market stress during the recent financial crisis by 16% to 30% relative to firms with no internal capital markets.

2013

2012

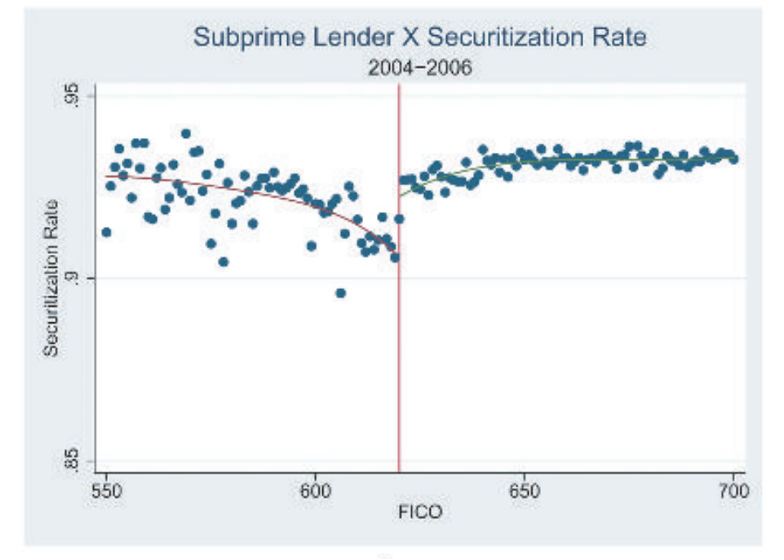

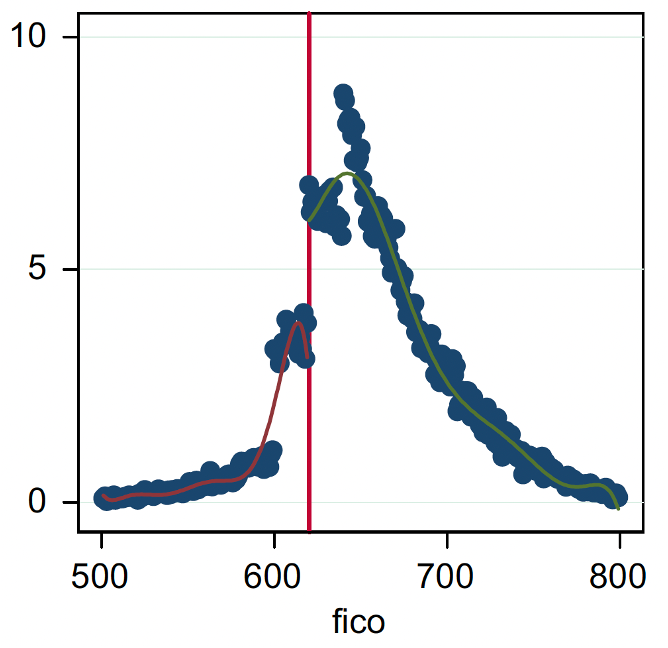

(with B Keys and V Vig), Review of Financial Studies, 2012, 25(8).

This article examines the link between mortgage securitization and lender screening during the boom and bust of the U.S. housing market. Using comprehensive data on both prime and subprime securitized and bank-held loans, we provide evidence that securitization affected lenders’ screening decisions in the subprime market for low-documentation loans through two channels: the securitization rate and the time it takes to securitize a loan. The change in decision-making by subprime lenders occurs on dimensions that are unreported to investors. Examining the time-series evolution of the securitization market further reinforces these findings. We exploit heterogeneity across subprime and prime markets to illustrate that the potential for moral hazard may be reduced with greater collection of hard information and increased monitoring of lenders. Our results suggest that the policy debate regarding securitization and lenders’ underwriting standards should separately evaluate the agency and non-agency markets, with special attention toward the extent of soft information in assets being securitized.

This is an abridged version with many results that appeared in the working paper: 620 FICO, Take II: Securitization and Screening in the Subprime Mortgage Market (with B Keys, T Mukherjee and V Vig)

2011

(with A Morse and V Nanda), Journal of Finance, 2011, 66(5), pp. 1779-1821

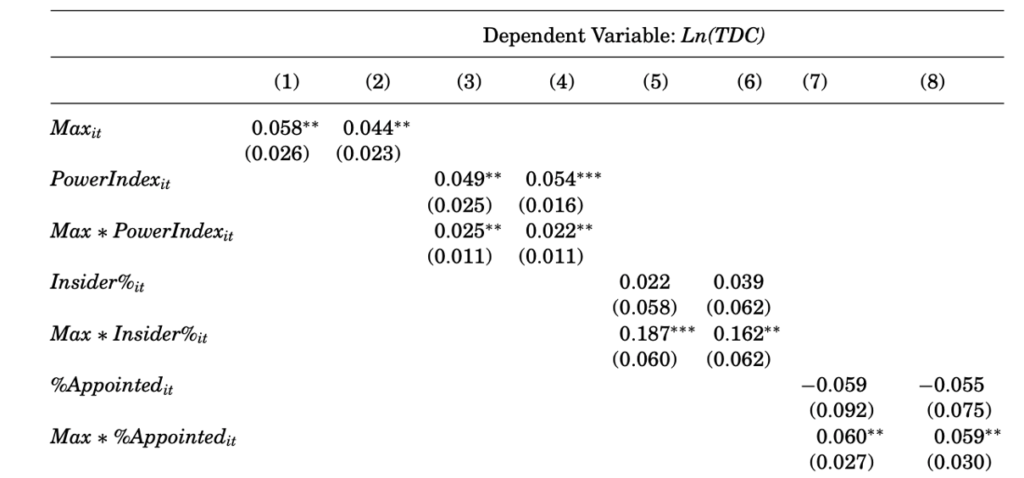

We argue that some powerful CEOs induce boards to shift the weight on performance measures toward the better performing measures, thereby rigging incentive pay. A simple model formalizes this intuition and gives an explicit structural form on the rigged incentive portion of CEO wage function. Using U.S. data, we find support for the model’s predictions: rigging accounts for at least 10% of the compensation to performance sensitivity and it increases with CEO human capital and firm volatility. Moreover, a firm with rigged incentive pay that is one standard deviation above the mean faces a subsequent decrease of 4.8% in firm value and 7.5% in operating return on assets.

2010

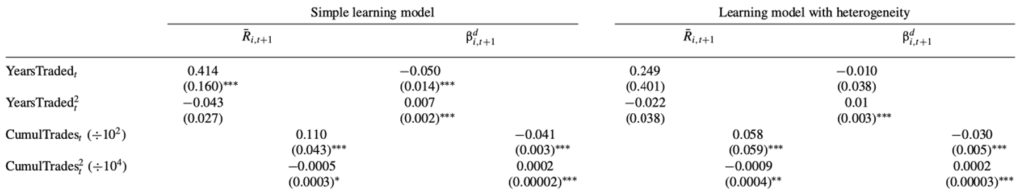

(with N Stoffman and T Shumway), Review of Financial Studies, 2010, 23(2), pp. 705-739.

Using a large sample of individual investor records over a nine-year period, we analyze survival rates, the disposition effect, and trading performance at the individual level to determine whether and how investors learn from their trading experience. We find evidence of two types of learning: some investors become better at trading with experience, while others stop trading after realizing that their ability is poor. A substantial part of overall learning by trading is explained by the second type. By ignoring investor attrition, the existing literature significantly overestimates how quickly investors become better at trading.

(with T Piskorski and V Vig). Journal of Financial Economics, 2010, 97(3), pp. 369-397.

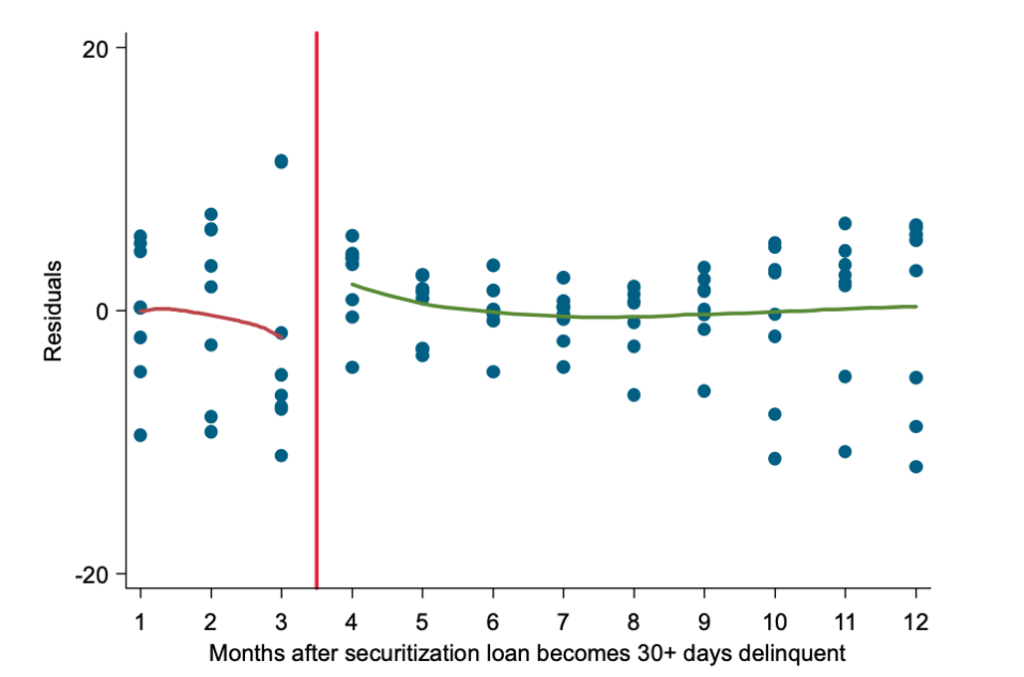

We examine whether securitization impacts renegotiation decisions of loan servicers, focusing on their decision to foreclose a delinquent loan. Conditional on a loan becoming seriously delinquent, we find a significantly lower foreclosure rate associated with bank-held loans when compared to similar securitized loans: across various specifications and origination vintages, the foreclosure rate of delinquent bankheld loans is 3% to 7% lower in absolute terms (13% to 32% in relative terms). There is a substantial heterogeneity in these effects with large effects among borrowers with better credit quality and small effects among lower quality borrowers. A quasi-experiment that exploits a plausibly exogenous variation in securitization status of a delinquent loan confirms these results.

(with U Rajan and V Vig). American Economic Review (Papers and Proceedings), 2010, 100(2), pp. 506-510.

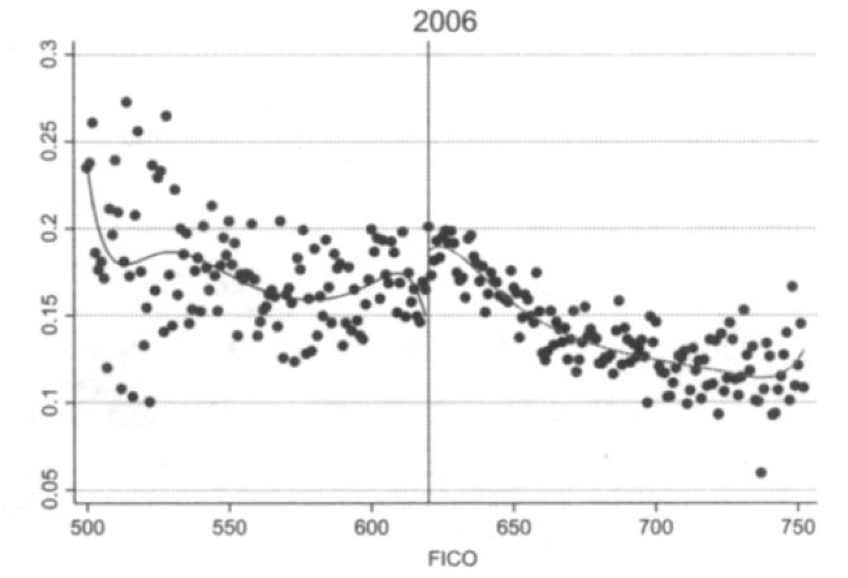

(with B Keys, T Mukherjee and V Vig), Quarterly Journal of Economics, 2010, 125(1), pp. 307-362.

A central question surrounding the current subprime crisis is whether the securitization process reduced the incentives of financial intermediaries to carefully screen borrowers. We empirically examine this issue using a unique dataset on securitized subprime mortgage loan contracts in the United States. We exploit a specific rule of thumb in the lending market to generate exogenous variation in the ease of securitization and compare the composition and performance of lenders’ portfolios around the ad-hoc threshold. Conditional on being securitized, the portfolio that is more likely to be securitized defaults by around 10-25% more than a similar risk profile group with a lower probability of securitization. We conduct additional analyses to rule out selection on the part of borrowers, lenders, or investors as alternative explanations. The results are confined to loans where intermediaries’ screening effort may be relevant and soft information about borrowers determines their creditworthiness. Our findings suggest that existing securitization practices did adversely affect the screening incentives of lenders.

Best Conference Paper: European Finance Association, Mitsui Conference, CAF and NISM. Chookaszian Endowed Risk Management prize. See 620 FICO, Take II for response to critique.

2009

(with B Keys, T Mukherjee and V Vig), Journal of Monetary Economics, 2009, 56(5), pp. 700-720.

We examine the consequences of existing regulations on the quality of mortgage loans originations in the originate to distribute (OTD) market. The information asymmetries in the OTD market can lead to moral hazard problems on the part of lenders. We find, using a plausibly exogenous source of variation in the ease of securitization, that the quality of loan originations varies inversely with the amount of regulation: more regulated lenders originate loans of worse quality. We interpret this result as possible evidence that the fragility of lightly regulated originators’ capital structure can mitigate moral hazard. In addition, we find that incentives which require mortgage brokers to have ‘skin in the game’ and stronger risk management departments inside the bank partially alleviates the moral hazard problem in this setting. Finally, having more lenders inside a mortgage pool is associated with better quality of loans, suggesting that sharper relative performance evaluation made possible by more competition among contributing lenders can also mitigate the moral hazard problem to some extent. Overall, our evidence suggests that market forces rather than regulation may have been more effective in mitigating moral hazard in the OTD market. The findings caution against policies that impose stricter lender regulations which fail to align lenders’ incentives with the investors of mortgage-backed securities.

2007

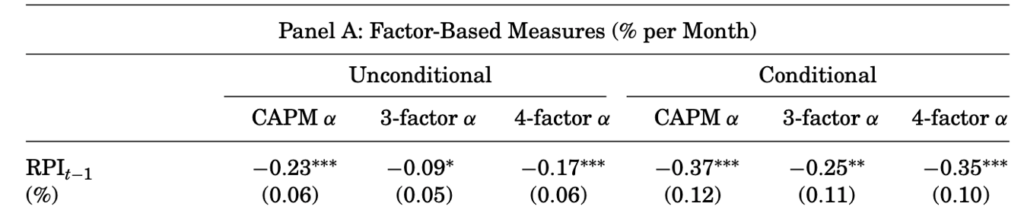

(with M Kacperczyk), Journal of Finance, 2007, 62(2), pp. 485-528. Lead Article. Nominated for 2007 Smith Breeden Award.

We show theoretically that the responsiveness of a fund manager’s portfolio allocations to changes in public information decreases in the manager’s skill. We go on to estimate this sensitivity (RPI) as the R2 of the regression of changes in a manager’s portfolio holdings on changes in public information using a panel of U.S. equity funds. Consistent with RPI containing information related to managerial skills, we find a strong inverse relationship between RPI and various existing measures of performance, and between RPI and fund flows. We also document that both fund- and manager-specific attributes affect RPI.

(with R Gopalan and V Nanda), Journal of Financial Economics, 2007, 86(3), pp. 759-795.

We investigate the functioning of internal capital markets in Indian Business Groups. We document that intragroup loans are an important means of transferring cash across group firms and are typically used to support financially weaker firms. Evidence suggests that an important reason for providing support may be to avoid default by a group firm and consequent negative spillovers to the rest of the group. Consistent with such spillovers, the first bankruptcy in a group is followed by significant drops in external financing, investments and profits of other firms in the group and an increase in their bankruptcy probability.